Black Monday 1987 stock market crash

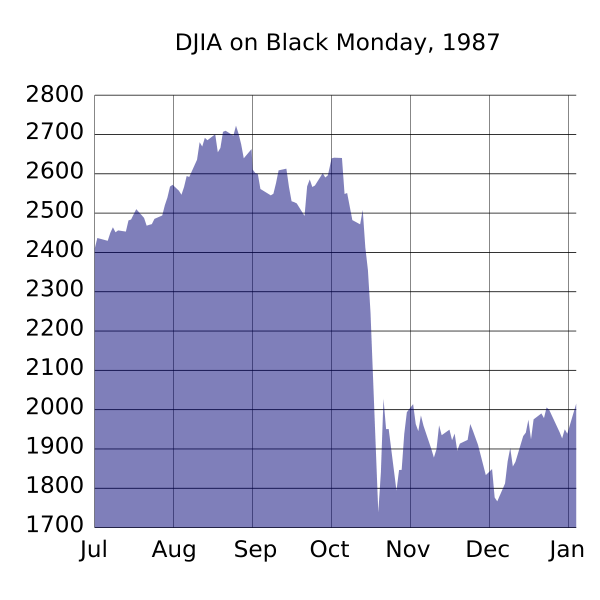

Black Monday 1987 refers to Monday 19th October, 1987. Stock markets all around the world crashed starting from Asia, then hitting Europe, followed by the United States. The Dow Jones in the US dropped a massive 22.6%. By the end of October the Hong Kong market registered 45.8% losses, the UK lost 26.4% of its value.

Fact: The Dow Jones Index, which dropped 22.6% in October, still registered a positive figure for 1987 as it started at 1897 points!

Reasons for the Black Monday 1987 stock market crash

The main reason cited for the crash was the increase in computer program trading. In the late 80’s computers were on the rise and their ability to buy and sell stocks quickly meant many traders were starting to use them. People blamed computer trading strategies for automatically selling stocks, without looking at the overall picture of the stock market.

Overvaluation of stocks was also a cause in the 1987 crash. There were many company takeovers and mergers, which inflate stock prices and the market as a whole. When investors think the market is overvalued they sell.

Another reason cited is market psychology, when people see the market dropping rapidly they do not want to be in a stock trade, they want to sell quickly and when lots of people do this, a snowball effect is created.

The lesson?

A dip or crash could be just around the corner. That’s why it’s crucial that a trader knows what she or he is doing, or you could lose a lot of money.

If you’re brand new to the share market then we highly recommend you start out with a practice trading account, because it allows you to learn the ropes with virtual money and move onto real money when you’re ready. With a practice account, you can also practice profiting from when the stock market is in recession by shorting stock.

Browse our stock market practice account reviews here…

Leave a Reply