Technical analysis explained

Technical analysis is the second stage in picking a stock to buy/sell. You should already have a list of companies whose financial performances match your criteria through basic fundamental analysis. Technical analysis is about studying stock chart patterns.

There are many patterns in charts that suggest whether a stock is about to rise or fall. These patterns are taught thoroughly in stock market trading courses. As well as patterns in the chart, there are several indictors that suggest whether the stock is going up or down. Again, indicators are taught in trading courses.

Technical analysis example

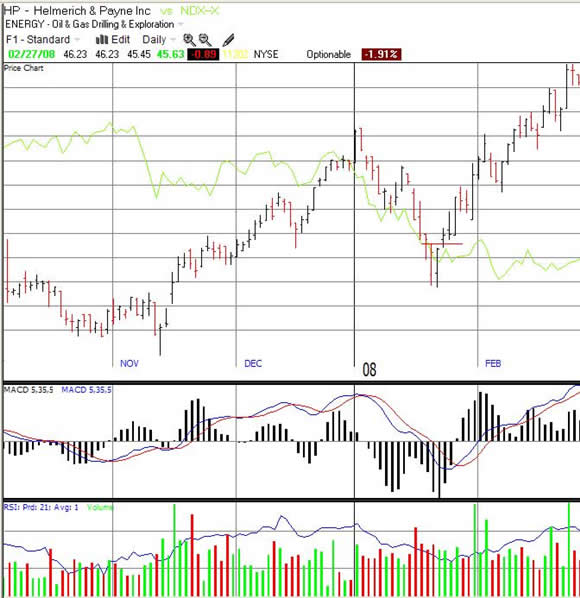

Below in the main chart area is a horizontal red line, below it are a red and black vertical bar which technical analysts would call a “pipe bottom”. Technical analysts suggest that when the stock rises above the high of the down (red line) day then the stock should be considered a “buy” as long it is backed up by sound fundamental analysis. As you can see the stock went on to rise around 23%.

Please be aware the example above is just an example and although “pipe bottoms” are considered a strong stock market signal, they can’t guarantee profits.

If a stock satisfies your fundamental and technical analysis, then the time is right to buy or short the stock.

For detailed technical analysis you will need to purchase charting software. See the list of recommended charting software here.

Learn more about technical analysis

There’s a lot to learn when it comes to technical analysis. If you’re finding it interesting, why not take a course that goes more in depth. Outside of the basic info on this site, there are a number of good online classes you can take at Udemy, books you can get from Amazon and many other sources of education.

View our recommended trading courses here…

Leave a Reply