Stock Dividends Explained

A stock dividend is the payment a trader receives from the company he/she is currently investing in.

The company pays the dividend from the profit it generates throughout its financial year. As a result, if the company fails to make a profit, dividends are not likely to be received by the investor.

The dividend is normally paid in two parts, an interim and a final dividend. This means if an investor has shares in a company for a year, they will normally get paid two lump sums a year (almost always in the form of cash).

To receive a dividend you must own the stock before the ex-dividend date. The dividend gets paid to the investor on the payment date set by each individual company, these dates can be found on a company’s investor relations section of their official website.

Continue reading to find out about dividends and how you can start receiving them soon.

Dividend example

- if you own 200 shares in a company and they cost $10 each ($2,000 total) before the ex-dividend date

- and the company issues a dividend of $0.10

- you will be entitled to a payment of $20! (($2000/$10)x$0.10)

By owning a stock before the ex-dividend date you will be entitled to the dividend regardless of whether you have owned the stock for 10 years, 10 months or 10 days!!

Note: Dividends are such a a good bonus that there are traders who only buy stock before the ex-dividend date and make their money on dividends rather than capital gains.

Find another great reason to trade stocks by checking out stop losses.

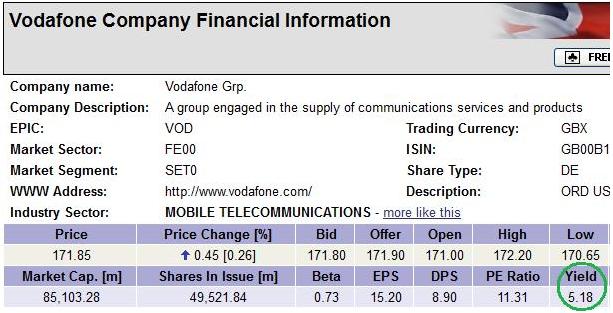

Dividend yield

The dividend yield (when referring to common shares) is the most recent full-year dividend / current share price. The figure is expressed as a percentage and indicates to traders the dividend they are likely to receive from trading a stock.

An easier way of looking at it is

- The share price of a company is $10

- The company offers a dividend of $0.30

- Therefore the dividend yield is 3%

- Meaning if an investor owned 1000 shares (worth $10,000) they would be entitled to a $300 payout!

Example

How to start receiving dividends

If you are looking to receive a form of income other than capital gains (i.e. dividends) then the dividend yield figure will help you pick out the companies paying the highest dividend. A simple search on a stock market practice account site will enable you to filter out the stocks with the highest dividend yield.

ADVFN.com lists the ex-dividend date of each stock. You then can save a list of high yielding stocks with their ex-dividend date and trade each stock just before the ex-dividend date arrives! Unless the stock drops considerably then this is a very easy way of making money!

Screen shots courtesty of ADVFN.com

I am new to all this. I can see where the ex-div rate is important to know.

What is the incentive for companies to offer dividends?

The incentive is to attract investors to the company’s shares. Attracting more investors creates stability of share price or helps the share price to rise.