Rights issue of shares

A rights issue is when a company issues its existing shareholders a right to buy additional shares in the company. The company will offer the shareholder a specific number of shares at a specific price. The company will also set a time limit for the shareholder to buy the shares. The shares are often offered at a discounted price to encourage existing shareholders to take the company up on their offer.

If a shareholder does not take the company up on their rights issue then they have the option to sell their rights on the stock market just as they would sell ordinary shares, however their shareholding in the company will weaken.

Reasons for a rights issue of shares

A company will offer more shares to its shareholders to raise extra money for the company. Companies with a poor cash flow will often use a rights issue to increase cash flow and pay off existing debts. Rights issues however are sometimes issued by companies with healthy balance sheets in order to fund research and development projects or to purchase new companies.

Discounted shares issued by a company can be tempting but it is important to find out first the reason for the rights issue of shares. A company, for example, may be using the rights issue as a quick cash fix to pay off debts masking the real reason for the company’s cash flow failing such as bad leadership. Caution is advised when offered with a rights issue.

Example of a rights issue of shares

- Company ‘ABC Mining’ has 10 million shares at a share price of $8 (market capitalization $80million)

- Joe Bloggs owns 1,000 shares worth $8,000

- ABC Mining needs to raise $30 million to research new mining locations.

- ABC Mining issues 5 million new shares @ $6 each (to raise $30 million, a 25% discounted price)

- This is classed a a 2 to 1 rights issue (10 million old shares : 5 million new shares)

- Which means every 2 shares you own ABC mining will issue another 1 share.

- This means Joe Bloggs is being issued with the right to buy a further 500 shares at $6 ($3,000)

Joe Bloggs can either;

- Buy the further 500 shares for $3,000.

- Ignore ABC Mining’s rights issue. This will result in Joe Bloggs share holding will be diluted along with the value of his current share holding. This option is not usually advised.

- Sell his rights on the stock market and make a profit (providing the rights are renounceable, if a company issues non-renounceable rights then they can not be traded

As you can imagine the stock price is likely to change after a rights issue of shares. This is called the ex-rights share price. It is possible to estimate the ex rights share price by;

- Taking Joe Bloggs original shareholding of 1000 shares @ $8.00 worth $8,000

- Taking Joe Bloggs new 500 shares @ $6.00 worth $3,000

- Adding the total values together $8,000 + $3,000 = $11,000

- Dividing the total value ($11,000) by the total number of shares (1500) = $7.33 per share.

However the ex-rights price can be influenced by many other factors such as the reason for the rights issue, the general direction of the stock market etc.

Real example of a rights issue of shares

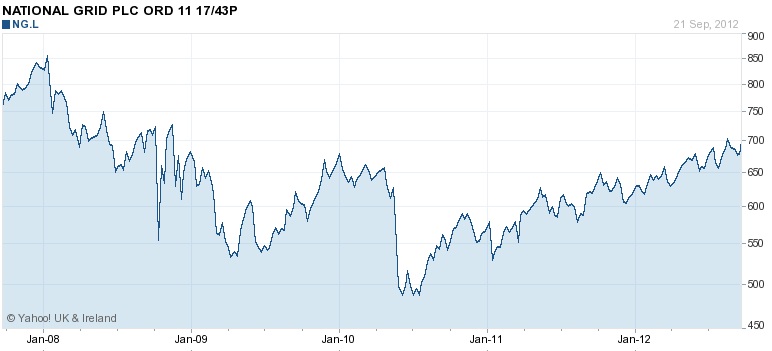

See below a real example of a rights issue from National Grid PLC. The issue was in May 2010 and the price drop in the share price is clear to see in the stock price chart below.

Read more about National Grid’s rights issue here.

Where to learn more

Now that you know about rights issues of shares, why not take a more in depth online course to learn more the stock market?

Understanding The Stock Market: For Beginners is a great online course that explains what the stock market is, how it began, how it’s structured, what the component parts are, how the whole thing works basically and how it applies to everyday life, people and making money.

Click here to see more of our recommended courses…

I am not at all sure about this. lf Joe Bloggs:

3.Sell his rights on the stock market and make a profit (providing the rights are renounceable.

What exactly does this mean if he hasn`t brought the extra shares offered in the first place, how can he the sell his ” rights” please explain, l am not an experienced shareholder.

Every right will have some value associated with it. For ex. in case of Joe, every share was earlier costing $8 and after rights issue, the share costs $7.33. So, the difference i.e. $.67 (8-7.33) would be the cost of having right to buy one share of ABC company.

This calculation is only viable for those who are holding rights to buy the share. So, if the rights issued by the company can be traded in the market, Joe can sell his rights and make profit against them.

It is not correct to say when you sell them you’ll make a profit. The value of the right you get, will devaluate the stock you have in exactly the same amount (in theory).

If you get the right to buy a stock for 5 and the stock has a value of 10. The value of the right is 5. If you exercise your right you pay 5 for the stock and ou sell it immediatley for 10 > 5 profit so the right is worth 5. Sometimes you can sell your rights.

Hi Karen,

A rights issue, as its name suggests, means that the existing shareholder is issued a right to buy the new shares at a discounted price. There are two types of rights issue, renounceable and non-renounceable.

In the case of a renounceable rights issue, the existing shareholder has a choice of renouncing that right and selling that right to a third party (could even be someone who is not an existing shareholder).

A non-renounceable rights issue will not allow the existing shareholder to sell the right to anyone else. He only has two choices, to buy the discounted shares or not to buy them.

Joe has been given an authority by the company to buy the Rights shares and no one else can have his authority unless he himself denounces it, eiher for free or for a consideration.

Joe will sell his authority given by the company particularly to him to some person, who will buy those Rights shares in place of Joe and pay Joe an agreed amount in return.

I have a doubt on rights issue.

for example : xyz company is currently trading at 25 and the company says through rights issue to stake holders it would give 1 share for every 6 shares held at a price of 31.

I dont understand why share holder should buy at 31 if the stock is trading at 25. he can buy through direct market any way at 25 right?

could some one please answer this?

sumanth,

Your example refers to warrants which are different that stock rights. Warrants a long term securities attached to an offering and as such they may generate a future profit to the holder if exercised at a time when the price of the underlying security goes above the subscription price ($31 in your case).

Really useful article – thanks SharesExplained! I am new to buying shares and the one company that I have invested in has just gone through a Rights Issue. I hold 1026 shares (@ value of £0.95) and have been offered 8 for every 5 I hold (@ value of £0.50). Seems like a no-brainer to me as I will bring my average share price down significantly, but it does mean that my initial investment of £1000 will need to be topped up by a further £820 – not what I envisaged when I first jumped in! I think i’ll have a dabble and see how it turns out…. I can always earn more money, right??!