Stock market crash 2008

Failures of major US banks on September 16th 2008, most notably the Lehman Brothers bank, resulted in a global financial crisis that affected banks throughout Europe. Iceland was worse hit and the value of its Krona reduced rapidly threatening to send the whole country into bankruptcy.

The failure of banks throughout the world hit the stock market badly. The US stock market lost 21% of its value that week, and although not numerically as bad as the 22.6% loss from Black Monday 1987, analysts say it was worse because the losses lasted all week and did not result from a ‘one-off’ down day.

The losses did not stop there however, in the week starting 6th October, the Dow Jones closed down 5/5 trading sessions and lost another 18% in the week. October the 24th also saw stock exchange indexes around the world drop around 10% in one day.

The UK stock markets were also badly hit. From early September to mid October 30% had been wiped off the value of the FTSE 100.

The FTSE 100 August 2008 – February 2009.

The main cause of the stock market crash 2008

The main cause of the stock market crash 2008 was subprime mortgage crises in the US. In short, companies were lending to people with bad credit ratings, and basically, to people who would struggle to pay back the loans (if at all). US banks were exposed to these loans and eventually collapsed. This was because they were lending more money than they had in their own bank! This is a called a debt to equity ratio, the figure below shows the approximate debt to equity ratios of UK banks around October 2008 and what eventually happened to them.

Northern Rock 1:1.8 > Collapsed and was nationalised, now 100% state owned.

Lloyds TSB 1:1.2 > Went from 0% to 43% state owned

HSBC 0.8:1 > Nothing

Note: HSBC’s debt to equity ratio was positive and they were the only bank that did not need government help.

When shareholders heard that banks were at risk and collapsing they did not want their money invested in bank shares, therefore they choose to sell their shares. This created a snowball effect around the stock market and widespread falls in stocks began.

The aftermath – recession and responses

The main responses in the UK and US was to bail out the banks with hundreds billions of pounds/dollars to get the banks to start lending money again. Shorting stock in financial companies was also temporarily banned. Interest rates were also dramatically slashed to encourage new businesses to form and people to start spending money.

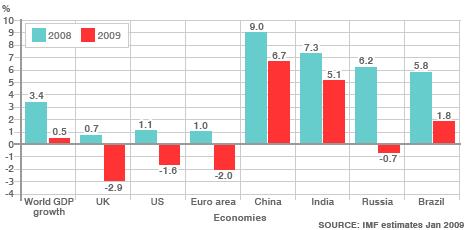

However all the dramatic responses could not stop the fact that the UK, US and many other countries were going into recession, see figure below.

Predicted economic slowdown 2008-2009

(source: BBC Business )

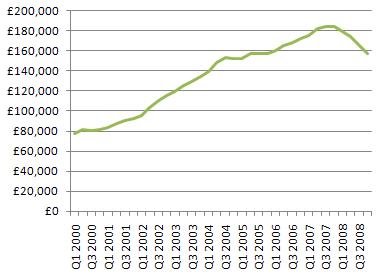

House prices in the UK since Q3 2007 have dropped by 15% and are still falling, see figure below.

2008 house price crash

UK officials predicted the recession would last around two years until the end of 2009 but many analysts advised it would be far worse…

The lesson?

A dip or crash could be just around the corner. That’s why it’s crucial that a trader knows what she or he is doing, or you could lose a lot of money.

If you’re brand new to the share market then we highly recommend you start out with a practice trading account, because it allows you to learn the ropes with virtual money and move onto real money when you’re ready. With a practice account, you can also practice profiting from when the stock market is in recession by shorting stock.

Browse our stock market practice account reviews here…

Leave a Reply