- home

- the basics

- the share

- trading shares

- Process to buy shares

- Why buy shares?

- How old to buy shares?

- Custodial account

- tax rules on shares

- styles of trading

- buying (going long)

- Shorting (going short)

- Stop losses

- How to choose a share

- Fundamental analysis

- Technical analysis

- Stock portfolio

- Trading courses

- Stock trading practice accounts

- brokerage account

- What is trading software

- Share newsletters

- the stock market

- Trading guide

- Advanced

- Glossary

- free stuff!

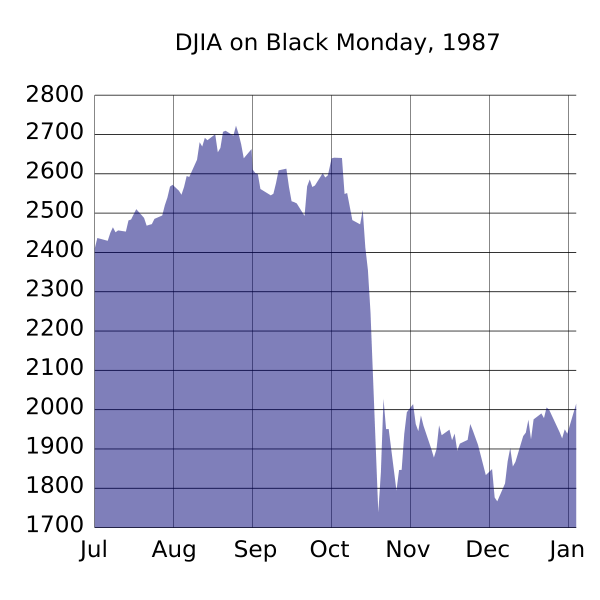

Black Monday 1987

Black Monday 1987 stock market crash in figures

Black Monday 1987 refers to Monday 19th October, 1987. Stock markets all around the world crashed starting from Asia, then hitting Europe, followed by the United States. The Dow Jones in the US dropped a massive 22.6%. By the end of October the Hong Kong market registered 45.8% losses, the UK lost 26.4% of its value.

Fact: The Dow Jones Index, which dropped 22.6% in October, still registered a positive figure for 1987 as it started at 1897 points!

Reasons for the Black Monday 1987 stock market crash

The main reason cited for the crash was the increase in computer program trading. In the late 80’s computers were on the rise and their ability to buy and sell stocks quickly meant many traders were starting to use them. People blamed computer trading strategies for automatically selling stocks, without looking at the overall picture of the stock market.

Overvaluation of stocks was also a cause in the 1987 crash. There were many company takeovers and mergers, which inflate stock prices and the market as a whole. When investors think the market is overvalued they sell.

Another reason cited is market psychology, when people see the market dropping rapidly they do not want to be in a stock trade, they want to sell quickly and when lots of people do this, a snowball effect is created.

Practice Trade!

SharesExplained.com

- Loading Quotes...

Free newsletter and gift!

Sign up now!SharesExplained.com

Stock market basics

Shares explained

Stock charts explained

Stock dividends explained

Stock Split Explained

Stock attributes

Why do shares move up and down?

How do I read a stock quote?

Understanding company financial statements

Rights issue of sharesThe process of buying shares

Why buy shares

Age limit for trading shares

Custodial account

Tax rules on shares

Styles of trading

Buying (going long)

Shorting stock (going short)

Stop losses explained

Picking shares

Fundamental analysis

Technical analysis

Portfolio/Watchlist

Trading courses

Practice accounts

Brokerage accounts

Trading software

NewslettersStock market explained

Stock exchanges

Indexs

Sectors

Bull/bear market

What market to buy shares

Factors that affect the stock market

When does the stock market open?Stock market trading guide

Step by step guide to trading shares

Practice accounts

Brokerage accounts

Trading courses

Trading software

Newsletters/tipsites

5 golden rules when trading shares

The risk:reward ratio

LeverageStock market games

Stock market 60

Stock market suicideAdvanced stock market trading

IPO (Initial Public Offering)

Automated trading

Bonds/gilts

Exchange traded funds (ETF's)

FOREX

Mutual Funds

Penny shares

Spread betting

Options Explained