- home

- the basics

- the share

- trading shares

- Process to buy shares

- Why buy shares?

- How old to buy shares?

- Custodial account

- tax rules on shares

- styles of trading

- buying (going long)

- Shorting (going short)

- Stop losses

- How to choose a share

- Fundamental analysis

- Technical analysis

- Stock portfolio

- Trading courses

- Stock trading practice accounts

- brokerage account

- What is trading software

- Share newsletters

- the stock market

- Trading guide

- Advanced

- Glossary

- free stuff!

Bull bear market

If you hear the phrase “its a bullish market” or a “bearish market” its simply referring to whether there is a rising or falling trend in the market.

- a bullish market refers to a market that has a long-term up trend. For a market to be bullish, investor confidence must be high and the market’s respective country will likely be showing solid economic growth. The number of stocks traded in a bull market is often high.

- a bearish market is referring to a market which has a long-term downtrend. A bear market will often arise when its respective country is in recession. The number of stock traded in a bear market is often low.

One theory as to where the bull and bear market got their names is due to the way the animals attack! A bull throws its horns up in the air and a bear swipes down at its prey.

A market usually gets labeled bullish or bearish after it has risen or fallen by over 20%. It is also important to note that stock markets generally fall quicker than they rise. This is because human fear of a loss is a stronger emotion than human that the satisfaction of gain!

Example

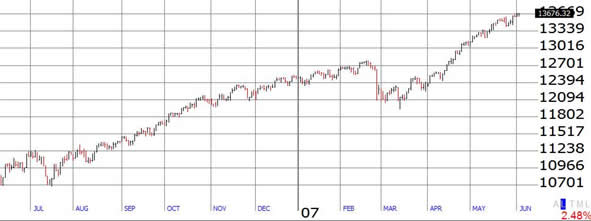

DJ30 Bullish market | June 2006 – June 2007

Example

S&P500 Bearish market | April 2008 – May 2009

(Screenshot courtesy of www.freestockcharts.com)

It should appear obvious but a general rule you should follow is to buy in a bull market and sell in a bear market, especially when swing or position trading. Its always hard work making money going against the overall trend.

Want to get some experience in trading shares (using virtual money) then open a fantasy trading account.

Want to know how to buy shares? Check out our step by step guide to buying shares.

Want to know how to make money when a share falls in value? Check out the shorting stock section.

Practice Trade!

SharesExplained.com

- Loading Quotes...

Free newsletter and gift!

Sign up now!SharesExplained.com

Stock market basics

Shares explained

Stock charts explained

Stock dividends explained

Stock Split Explained

Stock attributes

Why do shares move up and down?

How do I read a stock quote?

Understanding company financial statements

Rights issue of sharesThe process of buying shares

Why buy shares

Age limit for trading shares

Custodial account

Tax rules on shares

Styles of trading

Buying (going long)

Shorting stock (going short)

Stop losses explained

Picking shares

Fundamental analysis

Technical analysis

Portfolio/Watchlist

Trading courses

Practice accounts

Brokerage accounts

Trading software

NewslettersStock market explained

Stock exchanges

Indexs

Sectors

Bull/bear market

What market to buy shares

Factors that affect the stock market

When does the stock market open?Stock market trading guide

Step by step guide to trading shares

Practice accounts

Brokerage accounts

Trading courses

Trading software

Newsletters/tipsites

5 golden rules when trading shares

The risk:reward ratio

LeverageStock market games

Stock market 60

Stock market suicideAdvanced stock market trading

IPO (Initial Public Offering)

Automated trading

Bonds/gilts

Exchange traded funds (ETF's)

FOREX

Mutual Funds

Penny shares

Spread betting

Options Explained