- home

- the basics

- the share

- trading shares

- Process to buy shares

- Why buy shares?

- How old to buy shares?

- Custodial account

- tax rules on shares

- styles of trading

- buying (going long)

- Shorting (going short)

- Stop losses

- How to choose a share

- Fundamental analysis

- Technical analysis

- Stock portfolio

- Trading courses

- Stock trading practice accounts

- brokerage account

- What is trading software

- Share newsletters

- the stock market

- Trading guide

- Advanced

- Glossary

- free stuff!

Technical analysis explained

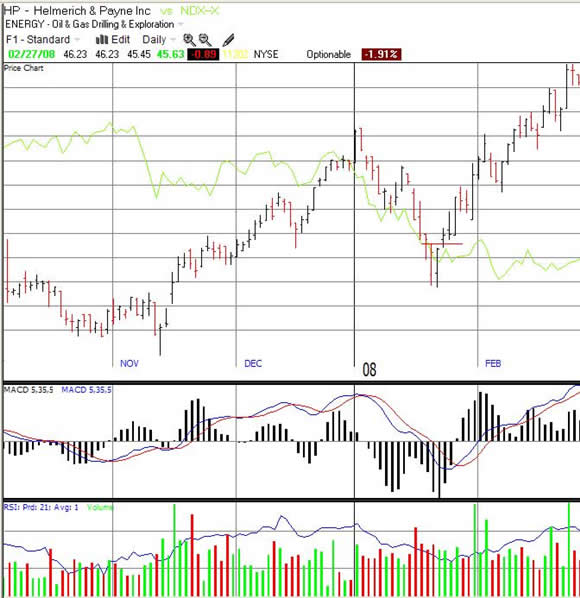

Technical analysis is the second stage in picking a stock to buy/sell. You should already have a list of companies whose financial performances match your criteria through basic fundamental analysis. Technical analysis is about studying stock chart patterns.

There are many patterns in charts that suggest whether a stock is about to rise or fall. These patterns are taught thoroughly in stock market trading courses. As well as patterns in the chart, there are several indictors that suggest whether the stock is going up or down. Again, indicators are taught in trading courses.

Example

Below in the main chart area is a horizontal red line, below it are a red and black vertical bar which technical analysts would call a “pipe bottom”. Technical analysts suggest that when the stock rises above the high of the down (red line) day then the stock should be considered a “buy” as long it is backed up by sound fundamental analysis. As you can see the stock went on to rise around 23%.

Please be aware the example above is just an example and although “pipe bottoms” are considered a strong stock market signal, they can’t guarantee profits.

If a stock satisfies your fundamental and technical analysis, then the time is right to buy or short the stock.

For detailed technical analysis you will need to purchase charting software. See the list of recommended charting software.

Practice Trade!

SharesExplained.com

- Loading Quotes...

Free newsletter and gift!

Sign up now!SharesExplained.com

Stock market basics

Shares explained

Stock charts explained

Stock dividends explained

Stock Split Explained

Stock attributes

Why do shares move up and down?

How do I read a stock quote?

Understanding company financial statements

Rights issue of sharesThe process of buying shares

Why buy shares

Age limit for trading shares

Custodial account

Tax rules on shares

Styles of trading

Buying (going long)

Shorting stock (going short)

Stop losses explained

Picking shares

Fundamental analysis

Technical analysis

Portfolio/Watchlist

Trading courses

Practice accounts

Brokerage accounts

Trading software

NewslettersStock market explained

Stock exchanges

Indexs

Sectors

Bull/bear market

What market to buy shares

Factors that affect the stock market

When does the stock market open?Stock market trading guide

Step by step guide to trading shares

Practice accounts

Brokerage accounts

Trading courses

Trading software

Newsletters/tipsites

5 golden rules when trading shares

The risk:reward ratio

LeverageStock market games

Stock market 60

Stock market suicideAdvanced stock market trading

IPO (Initial Public Offering)

Automated trading

Bonds/gilts

Exchange traded funds (ETF's)

FOREX

Mutual Funds

Penny shares

Spread betting

Options Explained