- home

- the basics

- the share

- trading shares

- Process to buy shares

- Why buy shares?

- How old to buy shares?

- Custodial account

- tax rules on shares

- styles of trading

- buying (going long)

- Shorting (going short)

- Stop losses

- How to choose a share

- Fundamental analysis

- Technical analysis

- Stock portfolio

- Trading courses

- Stock trading practice accounts

- brokerage account

- What is trading software

- Share newsletters

- the stock market

- Trading guide

- Advanced

- Glossary

- free stuff!

Stop losses

Stop losses are the same as a stop limit order, in terms of online trading, stop losses are a price you set at which your shares will sell automatically. Stop losses greatly reduce the risk involved in trading shares. Whenever you buy (go long) or sell (short) a share, brokerage accounts allow you attach stop losses for free to a share.

The standard stop loss

Is simply a price you set at which the share will automatically be sold.

Stop Loss Example 1

- you buy a share on an up trend @ $20.00

- you put a stop loss in @ $19.75

- the price could go down to $19.75 and your shares will be sold automatically

- meaning you will only ever lose 1.25% of your investment ((100/20)x19.75)

- however, if the stock went up you would set to gain a lot more than 1.25%!

Stop Loss Example 2

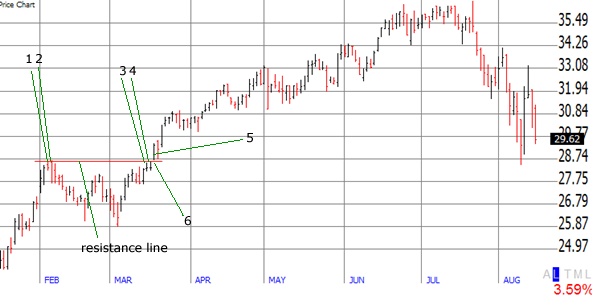

Helmerich & Payne Inc | January 2007 – August 2007

- the share hits the resistance line four times at points 1,2,3 and 4.

- you buy the share at point 5 when it move above the resistance line

- and put you stop loss at point 6 to sell the share at $28.53 (risking a loss of around 1%)

- however as the chart shows, it was possible to gain almost 25%!

Lets put that in monetary terms

- you buy 130 shares at $28.90 (point 5) = $3,757

- you risk around 1% = $37 [its important to note you will often lose this 1%]

- however in this example you could gain up to 25% = $939!!

- meaning that you could lose a lot more trades than win and still make money!

Stop Loss Example 3

Example 3 is going to show how stop losses work for shorting stock as well as buying.

Pulte Homes | June 2006 – April 2007

- the share hits the resistance line two times a points 1 and 2

- you sell the share when it breaks the resistance line at point 3.

- and put the stop loss at point 4 to buy back the share if it hits $30.50 (risking about 1.1%)

- however as this chart shows you could set to gain around 15%!

In monetary terms

- you sell 400 shares at $30.19 (point 3) = $12,076

- you risk around 1.1% = $120 [again, its important to note you will often lose this 1%]

- however in this example you could gain up to 15% = $1,811!!

Percentage stop losses

Percentage stop losses are similar to standard stop losses, they both have set at a fixed price at which the share sells. However the difference is in the way you set them. Standard stop losses you choose a number e.g. 19.75, but with percentage stop losses you choose a percentage of your trade you are willing to lose.

Example

- You buy 100 shares @ $20 = a $2000 investment

- You set the stop loss @ 3%

- The stop loss will be triggered if the share price reaches $19.40

- and the maximum you will lose is $60 (3%)

Trailing stop losses

Guess what, it gets better! There’s not just two kinds of stop losses, there’s another called a trailing stop loss. This type of stop loss follows the last price (current price) by a percentage or a numeric monetary value set by you.

Examples (based on a 3% trailing stop loss)

- If you set a 3% stop loss then and your stock drops 3% then it is automatically sold

- If your stock drops 2.5%, goes up 1% then back down by 1.5% then it is automatically sold

- If your stock rises 8% and then drops 3% then your stock is sold at a 5% profit.

- If your stock rises 9% then the minimum you take away is 6% profit etc.

- If your stock rises to 7% then your stop loss will stay at 4% until the stock rises over 7%, regardless of how much movement has taken place between the 4.01% and 7% profit levels.

The trailing stop loss is a great way to lock in your profit whilst still cutting any losses short. The disadvantage of a trailing stop loss is that if a stock’s price is erratic and your stop loss % is small then you are likely to be cut out of a trade.

Improving the psychology of trading

It is important to note that stop losses are important for the psychology aspect of trading as you have a set price to dispose of the share. By setting a stop loss, you avoid the situation of “I’m going to get rid of it in a minute as soon as it makes a bit of money back that i’ve lost ” and then lose even more! This is a classic thought process that goes through a traders head and by setting stop losses, the chance of this thought process is eradicated.

2 Responses to Stop losses

Leave a Reply Cancel reply

Practice Trade!

SharesExplained.com

- Loading Quotes...

Free newsletter and gift!

Sign up now!SharesExplained.com

Stock market basics

Shares explained

Stock charts explained

Stock dividends explained

Stock Split Explained

Stock attributes

Why do shares move up and down?

How do I read a stock quote?

Understanding company financial statements

Rights issue of sharesThe process of buying shares

Why buy shares

Age limit for trading shares

Custodial account

Tax rules on shares

Styles of trading

Buying (going long)

Shorting stock (going short)

Stop losses explained

Picking shares

Fundamental analysis

Technical analysis

Portfolio/Watchlist

Trading courses

Practice accounts

Brokerage accounts

Trading software

NewslettersStock market explained

Stock exchanges

Indexs

Sectors

Bull/bear market

What market to buy shares

Factors that affect the stock market

When does the stock market open?Stock market trading guide

Step by step guide to trading shares

Practice accounts

Brokerage accounts

Trading courses

Trading software

Newsletters/tipsites

5 golden rules when trading shares

The risk:reward ratio

LeverageStock market games

Stock market 60

Stock market suicideAdvanced stock market trading

IPO (Initial Public Offering)

Automated trading

Bonds/gilts

Exchange traded funds (ETF's)

FOREX

Mutual Funds

Penny shares

Spread betting

Options Explained

I think this statement is incorrect: If your stock drops 2.5%, goes up 1% then back down by 1.5% then it is automatically sold

The stop loss will be triggered only in case of a direct 3% drop and not an indirect(-2.5% +1% -1.5%)=3% drop. Can you explain this with an example??

Hi Anu,

The example is correct. The stop loss can be triggered by an indirect drop.