- home

- the basics

- the share

- trading shares

- Process to buy shares

- Why buy shares?

- How old to buy shares?

- Custodial account

- tax rules on shares

- styles of trading

- buying (going long)

- Shorting (going short)

- Stop losses

- How to choose a share

- Fundamental analysis

- Technical analysis

- Stock portfolio

- Trading courses

- Stock trading practice accounts

- brokerage account

- What is trading software

- Share newsletters

- the stock market

- Trading guide

- Advanced

- Glossary

- free stuff!

Stock Dividends Explained

What is a stock dividend?

A stock dividend is the payment a trader receives from the company he/she is currently investing in.

The company pays the dividend from the profit it generates throughout its financial year. As a result, if the company fails to make a profit, dividends are not likely to be received by the investor.

The dividend is normally paid in two parts, an interim and a final dividend. This means if an investor has shares in a company for a year, they will normally get paid two lump sums a year (almost always in the form of cash).

To receive a dividend you must own the stock before the ex-dividend date. The dividend gets paid to the investor on the payment date set by each individual company, these dates can be found on a company’s investor relations section of their official website.

Dividend Example

– if you own 200 shares in a company and they cost $10 each ($2,000 total) before the ex-dividend date

– and the company issues a dividend of $0.10

– you will be entitled to a payment of $20! (($2000/$10)x$0.10)

By owning a stock before the ex-dividend date you will be entitled to the dividend regardless of whether you have owned the stock for 10 years, 10 months or 10 days!!

Note: Dividends are such a a good bonus that there are traders who only buy stock before the ex-dividend date and make their money on dividends rather than capital gains.

Find another great reason to trade stocks by checking out stop losses.

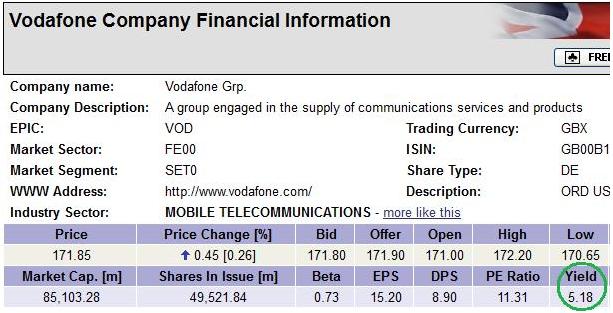

Dividend yield

The dividend yield (when referring to common shares) is the most recent full-year dividend / current share price. The figure is expressed as a percentage and indicates to traders the dividend they are likely to receive from trading a stock.

An easier way of looking at it is

– The share price of a company is $10

– The company offers a dividend of $0.30

– Therefore the dividend yield is 3%

– Meaning if an investor owned 1000 shares (worth $10,000) they would be entitled to a $300 payout!

Example

If you are looking to receive a form of income other than capital gains (i.e. dividends) then the dividend yield figure will help you pick out the companies paying the highest dividend. A simple search on a stock market practice account site will enable you to filter out the stocks with the highest dividend yield.

ADVFN.com lists the ex-dividend date of each stock, you then can save a list of high yielding stocks with their ex-dividend date and trade each stock just before the ex-dividend date arrives! Unless the stock drops considerably then this is a very easy way of making money!

Screen shots courtesty of ADVFN.com

3 Responses to stock dividends explained

Leave a Reply Cancel reply

Practice Trade!

SharesExplained.com

- Loading Quotes...

Free newsletter and gift!

Sign up now!SharesExplained.com

Stock market basics

Shares explained

Stock charts explained

Stock dividends explained

Stock Split Explained

Stock attributes

Why do shares move up and down?

How do I read a stock quote?

Understanding company financial statements

Rights issue of sharesThe process of buying shares

Why buy shares

Age limit for trading shares

Custodial account

Tax rules on shares

Styles of trading

Buying (going long)

Shorting stock (going short)

Stop losses explained

Picking shares

Fundamental analysis

Technical analysis

Portfolio/Watchlist

Trading courses

Practice accounts

Brokerage accounts

Trading software

NewslettersStock market explained

Stock exchanges

Indexs

Sectors

Bull/bear market

What market to buy shares

Factors that affect the stock market

When does the stock market open?Stock market trading guide

Step by step guide to trading shares

Practice accounts

Brokerage accounts

Trading courses

Trading software

Newsletters/tipsites

5 golden rules when trading shares

The risk:reward ratio

LeverageStock market games

Stock market 60

Stock market suicideAdvanced stock market trading

IPO (Initial Public Offering)

Automated trading

Bonds/gilts

Exchange traded funds (ETF's)

FOREX

Mutual Funds

Penny shares

Spread betting

Options Explained

I am new to all this. I can see where the ex-div rate is important to know.

What is the incentive for companies to offer dividends?

The incentive is to attract investors to the company’s shares. Attracting more investors creates stability of share price or helps the share price to rise.